Greater Long Island coverage is funded in part by Toresco & Simonelli, a boutique injury and family law firm in West Islip. They fight for their clients. Click here to learn more and to get in touch.

Column |

Nassau County residents pay the highest property taxes in the nation.

Suffolk County is behind on the list, but not by much, coming in at No. 5, according to the Tax Foundation.

But we live in a prime resort destination, right? White sandy beaches, historic sites and great park systems. It’s nice.

Too bad few of us could afford to actually vacation here, opting instead for long drives up into New England or down to the Carolinas, or flights to Florida or Texas.

I get it; this has do with supply and demand. Long Islanders are used to taking it on the chin, cost wise. We’ve done so for over a century as well-heeled residents from in and around New York City flock here in the warmer months — jacking up prices.

Yet our county governments have an opportunity to help us out — to help us take our Island back!

Little by little, right?

With local hotel prices objectively out of reach for many (go check out Montauk), the time is now to waive exorbitant hotel and motel occupancy taxes for county residents. We already pay taxes here year-round. We don’t cause any population swells when we vacation within our own county borders.

And a chunk of the hotel and motel occupancy tax revenues goes to promoting tourism on Long Island.

Which, as Long Islanders, makes it feel as if we’re paying to market to ourselves.

By the numbers

Consider the counties’ respective hotel and motel occupancy tax rates: 3 percent per day in Nassau County and a whopping 5.5 percent in Suffolk, which jacked up the tax last year from 3 percent.

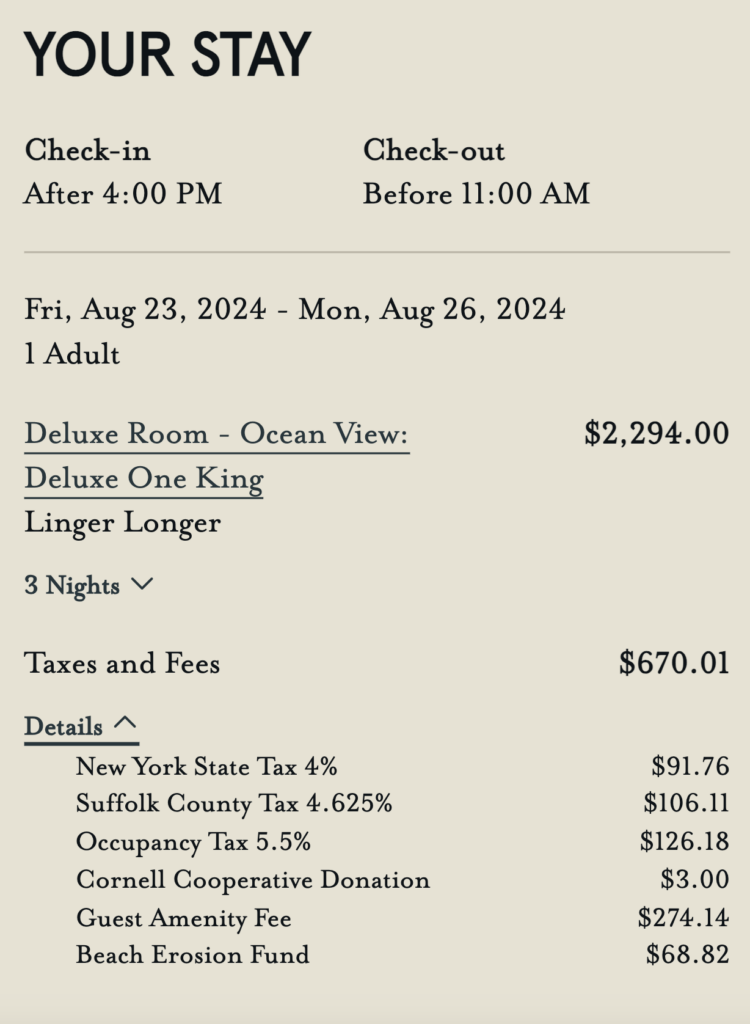

A three-night August stay — Friday afternoon through Monday morning — at the Sound View in Greenport, with a room looking at the Sound of course, will run you precisely $324.05 in taxes alone.

That figure includes state sales tax at 4 percent ($91.76), the county sales tax, which is even higher, at 4.625 percent ($106.11) and the highest of them all, the Suffolk County hotel and motel occupancy tax, at 5.5 percent ($126.18).

Source: Sound View website

Let’s look at some Nassau numbers.

A three-night stay in August at the Allegria Hotel in Long Beach — with an ocean view, because that’s why we’re here — will run you $316.92 in taxes.

The Allegria bill only breaks things down between Exclusive Tax ($202.86) and Custom Tax ($114.06), whatever that means, but if we’re doing the 3 percent math on a total, pre-tax bill of $1,745 that’s $52.35 on the occupancy tax. For just three nights.

And who really wants to vacation for three nights?

Source: Allegria Hotel website

(Allegria does offer discounted rates for New York, Connecticut and New Jersey residents with a valid ID, possibly to offset the high taxes. But should this really fall on the business owners?)

To be sure, occupancy taxes are commonplace across the country, however that shouldn’t stop Suffolk and Nassau county leaders from taking a novel approach to helping out the locals, who are already overtaxed and financially overburdened.

This is our Island. We pay into it. We care for it.

And we need a vacation, one that shouldn’t have to involve bridges or airports.

Top: A sunset at the Sound View in the dead of winter. (Credit: GLI file photo/Michael White)